Project Portfolio Management

RLS uses Project Portfolio Management (PPM) algorithms to find the optimal allocation of limited funds and resources across multiple projects. Project Portfolio Management (PPM) provides the ability to significantly reduce cost, increase delivery efficiency, save revenue for other investments, and more effectively deploy an organization’s workforce in strategically aligned initiatives.

RLS uses Project Portfolio Management (PPM) algorithms to find the optimal allocation of limited funds and resources across multiple projects. Project Portfolio Management (PPM) provides the ability to significantly reduce cost, increase delivery efficiency, save revenue for other investments, and more effectively deploy an organization’s workforce in strategically aligned initiatives.

Managing projects together as a portfolio provides insights and opportunities to allocate limited resources (e.g., money) to optimize the return on investment (ROI) and keep the projects’ risk exposures acceptable to the organization. Broadly speaking, a portfolio can be used to represent any set of activities designed to maximize some objective and which are competing for the same pool of limited resources.

Services

Project Portfolio Inception & Management

Projects are unified into a Project Portfolio. The Portfolio is analyzed to determine the optimal resource allocation among projects.

Optimal Sequence Modeling

Optimal sequence model of decisions and unknowns, with input from Subject Matter Experts and Best Practices. These models become the comprehensive plan of action to be managed to achieve project goals.

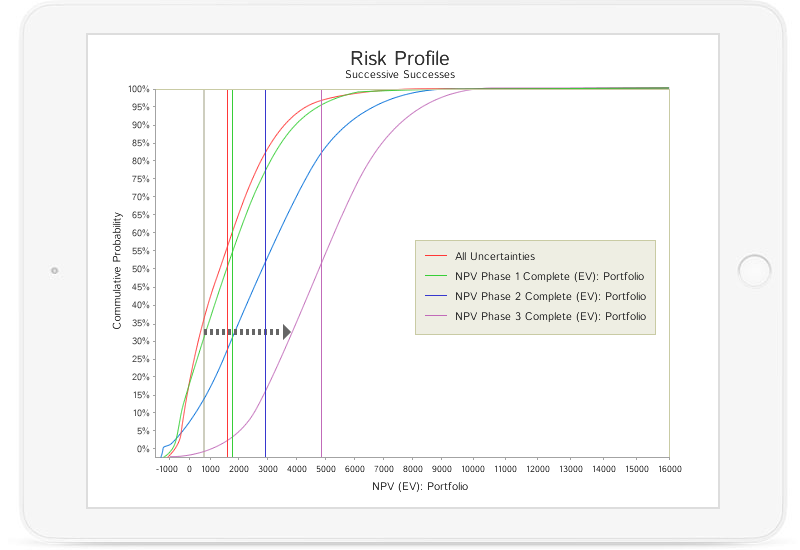

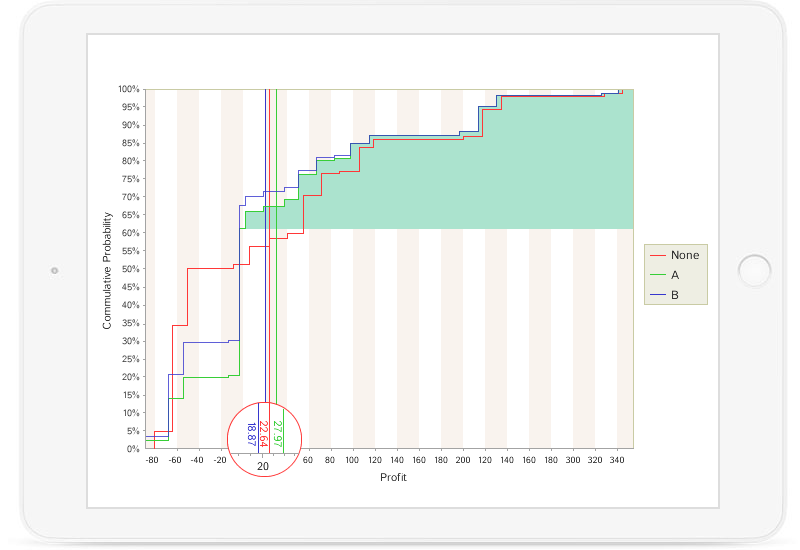

Portfolio Risk Profiling

Risk profile of the NPV (net present value) of the entire Portfolio, plotting the expected NPV of each Project’s success (x-axis) against cumulative probability of success (y-axis).

Risk/Reward Bubble Charting

Risk/reward chart, plotting expected NPV of each Project’s success (x-axis) against probability of success (y-axis). Varied bubble sizes represent expected costs.

Productivity Ratio Charting

Calculated as the expected value of the objective (NPV) divided by the expected value of the investment (i.e. development costs). Used to compare projects and determining which deserve funding, and in what order.